Get the free wr1 form download

Show details

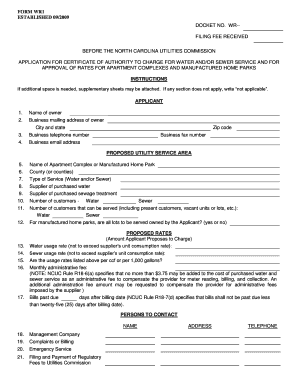

Mass. gov/dor and click on the WebFile for Employers Quick Link. DOR issues preprinted wage reporting forms Form WR-1 to all Massachusetts employers who reported 21 or fewer employees in the previous quarter. BULK RATE U.S. POSTAGE PAID COMMONWEALTH OF MASSACHUSETTS Massachusetts Department of Revenue PO Box 7029 TO Boston Massachusetts 02204 Form WR-1 Employer s Quarterly Report of Wages Paid Commonwealth of Massachusetts Dear Employer Would you...

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign

Edit your wr1 form download form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your wr1 form download form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing wr1 form download online

To use the services of a skilled PDF editor, follow these steps below:

1

Create an account. Begin by choosing Start Free Trial and, if you are a new user, establish a profile.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit ma wr 1 form. Text may be added and replaced, new objects can be included, pages can be rearranged, watermarks and page numbers can be added, and so on. When you're done editing, click Done and then go to the Documents tab to combine, divide, lock, or unlock the file.

4

Get your file. When you find your file in the docs list, click on its name and choose how you want to save it. To get the PDF, you can save it, send an email with it, or move it to the cloud.

The use of pdfFiller makes dealing with documents straightforward.

How to fill out wr1 form download

How to fill out wr 1 form?

01

Obtain the wr 1 form from your employer or download it from the relevant government website.

02

Fill in your personal information, including your name, address, and social security number.

03

Provide details about your employment, such as the name and address of your employer, your job title, and the dates of employment.

04

Declare your total wages earned during the specific period mentioned in the form.

05

Report any federal income tax withheld from your wages.

06

Review and double-check all the information you have entered for accuracy.

07

Sign and date the form.

08

Submit the completed wr 1 form to your employer or the appropriate government agency.

Who needs wr 1 form?

01

Employees working in the United States for any employer.

02

Individuals who have received wages or income subject to federal income tax withholding.

03

Employers who need to report wages and income tax withholdings to the Internal Revenue Service (IRS).

Fill massachusetts wr 1 form : Try Risk Free

Our user reviews speak for themselves

Read more or give pdfFiller a try to experience the benefits for yourself

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is wr 1 form?

The term "wr 1 form" is a bit ambiguous and could refer to different things depending on the context. Here are a few possible meanings:

1. WR-1 Form (Employment Eligibility Verification): This refers to the Form I-9, also known as the "Employment Eligibility Verification" form, used in the United States to verify an employee's identity and authorization to work in the country.

2. WR-1 Form (Tax Forms): In some countries, tax authorities may use a WR-1 form to collect information about employee wages and tax withholdings. However, the specific details and format of this form can vary depending on the country and its tax administration system.

3. WR-1 Form (Motor Vehicle Title Application): Some states or regions may use a WR-1 form as an application for motor vehicle title registration or transfer, including information about the owner, vehicle details, and any liens or encumbrances.

It is important to note that the specific meaning of "WR-1 form" may vary based on the country, industry, or organization in question.

Who is required to file wr 1 form?

In the context of the United States, the Form W-1 is not a recognized form. Employers in the U.S. are typically required to file Form W-2, which reports wages and other compensation paid to employees.

How to fill out wr 1 form?

To fill out the WR-1 Form, you can follow these steps:

1. Obtain the WR-1 Form: You can download the form from the Internal Revenue Service (IRS) website or request a hard copy from the IRS.

2. Provide employer information: Enter your business name, address, and employer identification number (EIN) in the appropriate fields. If you are a household employer, you can provide your social security number instead of an EIN.

3. Indicate employment details: Include the start and end dates of your employment tax liability period. This period is usually one year, unless you are a seasonal employer. If you are required to file Form 943 (Employer's Annual Federal Tax Return for Agricultural Employees), indicate this as well.

4. Enter your contact information: Provide your name, job title, and contact details in the designated fields.

5. Indicate the type of employer: Check the appropriate box to specify your employer category (for example, agricultural employer, household employer, nonfarm employer, etc.). If you are uncertain about the correct category, consult the instructions provided with the form or seek professional advice.

6. Sign and date the form: As the employer, you must sign and date the WR-1 Form, indicating your agreement to comply with federal employment tax requirements.

7. Retain a copy: Make sure to keep a copy of the completed WR-1 Form for your records.

Note: Keep in mind that this response is intended only as a general guideline. It is recommended to consult the specific instructions provided by the IRS for accurate and up-to-date guidance on filling out the WR-1 Form.

What is the purpose of wr 1 form?

The term "wr 1 form" is not a commonly used or widely recognized term, so it is difficult to determine the exact purpose of a wr 1 form without further context. Please provide more information or clarify the specific field or industry in which this form is used.

What information must be reported on wr 1 form?

The WR-1 form, also known as the Employer's Report of Work-Related Injury or Illness, is typically used to report work-related injuries or illnesses to the relevant workers' compensation authorities. The information that must be reported on the form may vary based on the jurisdiction, but generally includes the following:

1. Employer information: Name, address, contact details, and identification number of the employer.

2. Employee information: Name, address, contact details, and identification number of the employee who suffered the injury or illness.

3. Injury/Illness details: Description of the injury or illness, including the body part affected, cause of the injury/illness, and date and time it occurred.

4. Medical treatment information: Details of the medical treatment provided to the injured/ill employee, including the name and address of the medical provider, the date and time of treatment, and a description of the treatment received.

5. Lost work time: Information on the number of days missed from work due to the injury or illness.

6. Wage details: The employee's regular wage or rate of pay, usual hours worked, and any overtime pay.

7. Witnesses: If applicable, names and contact information of any witnesses to the incident.

8. Supervisor information: Full name and contact details of the immediate supervisor or manager who is responsible for submitting the report.

9. Additional remarks: Any additional information or remarks that may be relevant to the incident or the injury/illness.

It is important to note that the specific details required on the WR-1 form may vary depending on each jurisdiction's regulations and requirements.

What is the penalty for the late filing of wr 1 form?

The penalty for late filing of the WR-1 form, also known as the Employer Report of Industrial Injuries, can vary depending on the jurisdiction and specific regulations in place. In general, late filing of this form may result in fines or penalties imposed by the relevant government agency responsible for workers' compensation or occupational health and safety. It is advisable to consult the specific regulations applicable to your jurisdiction or seek guidance from an expert in labor laws or workers' compensation to know the exact penalties that may apply.

How can I manage my wr1 form download directly from Gmail?

In your inbox, you may use pdfFiller's add-on for Gmail to generate, modify, fill out, and eSign your ma wr 1 form and any other papers you receive, all without leaving the program. Install pdfFiller for Gmail from the Google Workspace Marketplace by visiting this link. Take away the need for time-consuming procedures and handle your papers and eSignatures with ease.

How do I execute mass form wr 1 online?

Completing and signing form wr 1 online is easy with pdfFiller. It enables you to edit original PDF content, highlight, blackout, erase and type text anywhere on a page, legally eSign your form, and much more. Create your free account and manage professional documents on the web.

How do I complete wr1 form massachusetts on an Android device?

Use the pdfFiller Android app to finish your ma form wr 1 and other documents on your Android phone. The app has all the features you need to manage your documents, like editing content, eSigning, annotating, sharing files, and more. At any time, as long as there is an internet connection.

Fill out your wr1 form download online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Mass Form Wr 1 is not the form you're looking for?Search for another form here.

Keywords relevant to what is ma form wr1

Related to form wr 1 massachusetts wage reporting system

If you believe that this page should be taken down, please follow our DMCA take down process

here

.